6 steps on how to price a product and achieve profitable markups

How you price your products can influence everything from cash flow to profit margins to whether you’re able to effectively grow your business.

Getting it right can help you boost profits and build a loyal customer base who both buy your products and recommend them to others. But getting it wrong can aggravate your customers and thus negatively impact your brand reputation.

It’s a fine line to tread, but with the right research and preparation, you can administer a strategy where product price complements product value.

In this post, you’ll learn how to research your market and calculate your business costs to find a sustainable price for your products, as well as the best pricing models to stay competitive and achieve success.

Top Tip: Figuring out how to price your product falls into the market research umbrella. Market research will help you to figure out the demand for your product or service in your target industry, the market saturation, market size, key economic indicators, who your ideal customers are, who your competitors are, and how to strategically get in front of your target audience. To learn more, read our guide on how to conduct market research for your business idea 📌

Table of contents

- Research the market

- Decide on your small business goals

- Work out your costs

- Find the right pricing strategy

- Consider other product pricing factors

- Monitor your prices

- Wrapping up

1. Research the market

According to Nielsen, 32% of global consumers say that price is the key factor influencing choice of brand. Meanwhile, 28% of consumers are influenced by the fact that a brand is well known and trusted.

Further, approximately two-thirds of UK consumers state that when choosing what to buy, price is the most important factor.

These statistics show that even if your brand is new to the market, you have a good chance of competing if your product pricing is right.

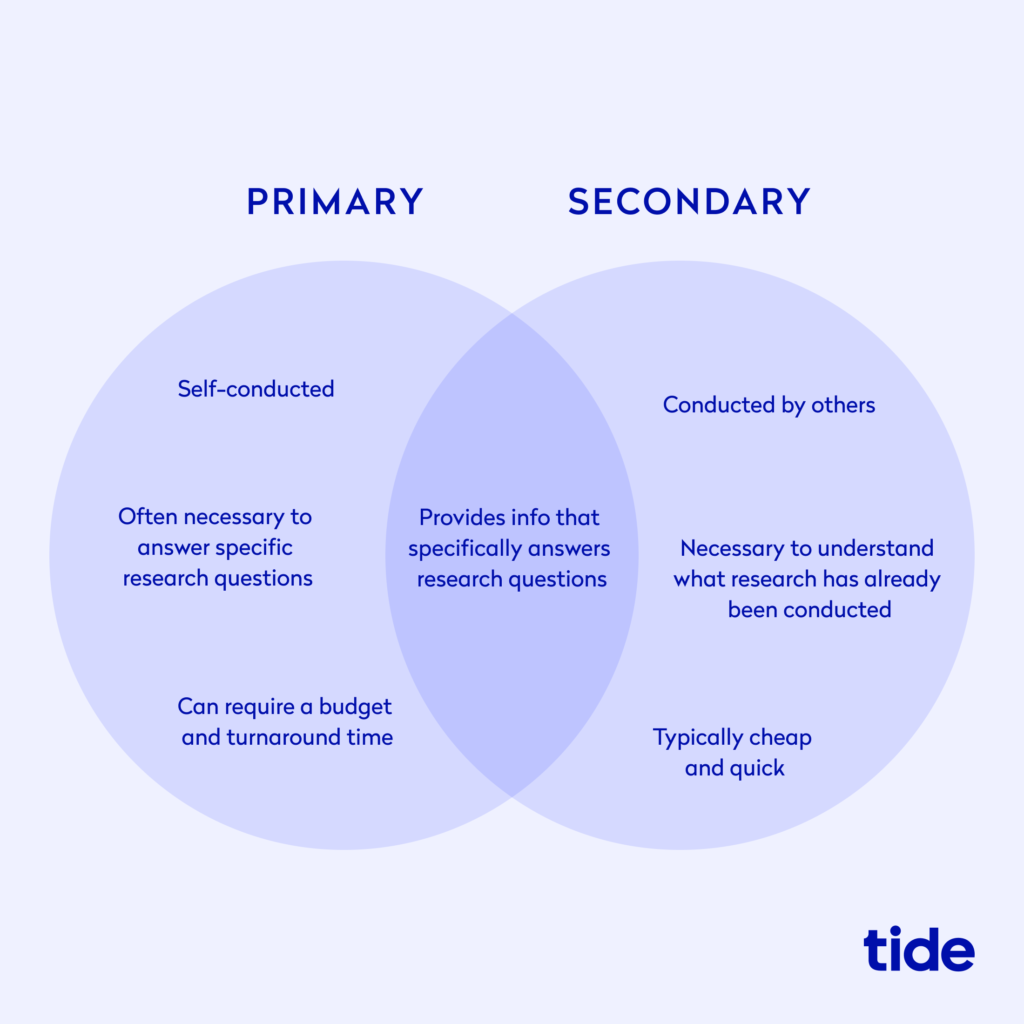

In general, market research falls into two buckets: primary and secondary. And within each bucket, you can conduct qualitative research (i.e. data from first-hand observations) and quantitative research (i.e. collecting and analysing big data).

Quantitative research that analyses publicly available data is the easiest place to start when considering your price points.

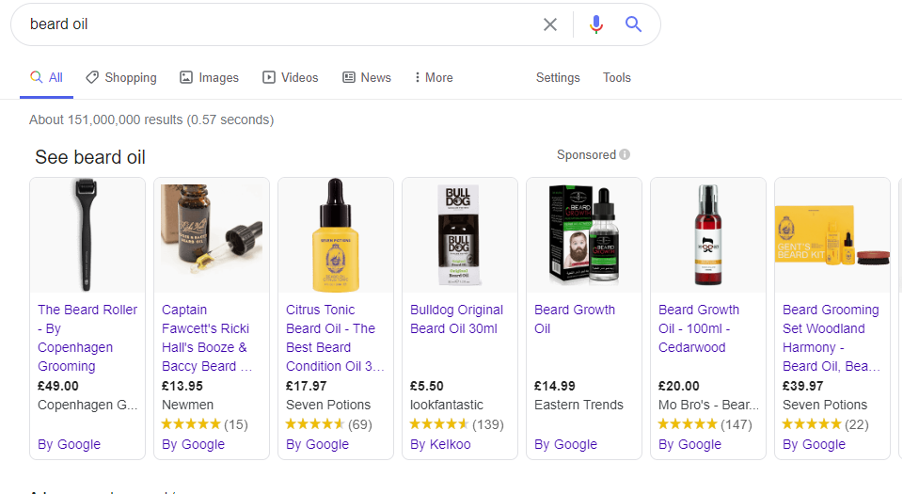

While competitor pricing should not be the sole factor in determining your final price, researching the average pricing in your niche will give you a good indicator of the market. To do this, simply type your product keywords into Google.

For example, let’s say you want to launch a range of beard oils. Entering ‘beard oil’ into Google will bring up shopping results for this term.

Clicking on the ‘Shopping’ tab lets you explore these products further. Find brands and products that are similar to yours and take note of prices. Comparing four or five will give you an average retail price.

Then, look at each brand individually to see if your product offers additional value. If your product comes with something extra—such as a beard comb or a grooming guide—you may be able to command a higher price.

To be sure, you’ll need to conduct primary research to communicate directly with your target audience to see if commanding a higher price for additional value is something that aligns with their needs, pain points, desires and buying behaviour.

Let’s explore how to do just that.

Talk to potential customers

Audience research is a key part of deciphering the right product price. Talking to potential customers and people with an interest in your product will help you find out what’s important to them.

You can gather insights from your target audience through questionnaires, emails, phone calls, in-person meetings or online forums such as social media groups.

If you’re launching a new product to an existing customer base, you have a ready-made audience from which to get feedback. If your product launch is coinciding with the launch of a new business, you’ll need to find a suitable audience.

In this case, start with family and friends and see if they’re willing to help spread the word by further sharing your questionnaire to their individual social groups.

For example, you can ask your target customers:

- How much they would be willing to pay for your product or a similar one

- What motivates them to buy (e.g. price, quality or consistency)

- If they make purchasing decisions based on price or perceived brand value

- If they equate higher quality with higher prices and vice versa

If you’re carrying out research in person, you could also use your questionnaire alongside product samples to find out how customers perceive your brand. Let customers try your product, then ask them to give it a price based on a list of predetermined prices from your competitor research.

Top Tip: Speaking directly to your customers to uncover what motivates their buying behaviour goes a long way when it comes to marketing your new product or service, too. In fact, building customer personas and continuously gathering audience insights will help you to meaningfully engage with your existing and potential customers. To learn more, read our 5-step guide to building an effective go-to-market (GTM) strategy 🚀

2. Decide on your small business goals

Pricing goes hand-in-hand with what you want to achieve as a business owner. Now that you have a better understanding of your market, think about how those insights tie into your business goals.

Based on a set timeframe (e.g. one, three or five years), ask yourself:

- How much revenue do I want to make?

- How much profit do I want to make?

- How many sales do I want to achieve?

- How do I want my brand to be perceived?

If you want to make a lot of sales, it might make sense to set the selling price of your products low. However, this may position your brand at the budget end of the market, which can come with negative connotations such as products being seen as low quality compared to higher-priced alternatives.

On the flip-side, if you want to make a lot of revenue, you might set high prices and settle for a lower sales volume. This can help position your brand as being high quality in the mind of the consumer but may alienate people who shop based on price alone.

And if you want to make a lot of sales and revenue, it may make more sense to choose a middle-of-the-pack price point until you can boost brand awareness and thus increase perceived value.

If you can set yourself apart from the crowd through excellent brand recognition, customer loyalty and unique offerings, you’ll be able to raise your price point based on the value you’ve created thus far.

There is no right or wrong answer here. But working out what you want to achieve and how you want your product to be seen will give you a good idea of how to price your product, and which brands and products you’ll be competing against.

Top Tip: The best way to uncover your small business goals, especially when it comes to revenue and profits, is to create a structured business plan. A business plan is your company roadmap that outlines what your business does, how it’s going to work and how you’re going to achieve your goals. To learn more, read our complete guide to writing your company roadmap and creating your business plan💡

3. Work out your costs

By this stage, you should have a good idea of how to price your product. Now you need to see if the price you have in mind is sustainable.

There are three steps to working out a sustainable price for your product:

- Calculate variable costs

- Add profit margin

- Add fixed costs

Top Tip: Understanding the basics of small business accounting will help you tremendously when it comes to ensuring that your business has a positive cash flow and remains profitable. While we’re about to explain some basics, it’s key to understand how to streamline your accounting process from the get-go. To learn more, read our complete guide to accounting for startups 📣

1. Calculating your variable costs

Variable cost is the price of materials, labour and distribution associated with every product you sell.

To calculate product costs, you need to add every expense that goes into making and selling it. This includes design, manufacturing, labour, distribution and promotion.

For example, let’s say you were selling printed t-shirts. Each plain t-shirt costs £2.00 wholesale.

First, you have to consider the cost of your time to create the designs. You can calculate this by setting an hourly rate that you want to make from your business and dividing that number by how many t-shirts you can design in an hour.

So if you want to make £20.00 an hour and can design four t-shirts in that time, that’s £5.00 per t-shirt.

Next, you need to factor in the additional manufacturing costs. Say the printing company costs £100.00 an hour and prints an average of 40 t-shirts an hour. That makes the manufacturing cost for each t-shirt £2.50.

Then you need to add the packaging costs and shipping costs per t-shirt, costing £1.50 and £3.00 respectively.

Breaking down each of the expenses like this will give you a variable cost:

- Cost of plain t-shirt: £2.00

- Cost of design production: £5.00

- Cost of printer: £2.50

- Cost of packaging: £1.50

- Cost of shipping: £3.00

Total cost per t-shirt: £14.00

Depending on your business structure, you may also need to add costs for promotion and commission. Either way, make sure to break down every single cost involved in getting your product(s) in the hands of a customer.

You can then use this information to determine how much to charge your customers for your product.

2. Add profit margin

Profit margin is how much you want to make per product on top of your variable costs.

For example, let’s say you want to make 30% profit on top of every t-shirt you sell. You need to take that 30% and turn it into a decimal (0.3) and then subtract 1:

0.3 – 1 = 0.7.

Your target product price is your variable cost per product (£14.00) / your desired profit margin (0.3) – 1:

£14 / 0.7 = £20.00.

Therefore, your target product price is £20, which is 30% more than your variable costs.

Top Tip: Monitoring your net profit margin will help you understand how much profit your business is generating as a percentage of your total revenue. To learn more about why this is important to track, how to calculate it and tips for how to improve it, read our guide to what net profit is and how to calculate it ⚡️

3. Add fixed costs

Fixed costs are the costs in your business that are constant regardless of the number of products sold. Examples of fixed costs include rent, business rates, website costs, loan payments, insurance and utilities.

These need to be factored into your overall price per product. At the moment, taking into account your variable costs, you would be making £6 per t-shirt sold.

However, you need to pay fixed costs to stay in business, which means you’ll have to sell a certain number of products every month to break-even.

Your break-even volume is:

Fixed costs / profit margin after variable costs

So let’s say your fixed costs for your premises, ecommerce site and utilities is £1000 per month.

1000 / 6 = 166.6

You can round that up to 167, meaning you’d need to sell 167 t-shirts a month to break even.

Taking these calculations into account, you’ll be able to see if your desired price is sustainable and competitive.

Working out your costs and setting the price based on how much you want to make per product is known as markup, or cost-plus, pricing. It’s a commonly used pricing strategy, but it’s not the only one.

Let’s take a look at some other options.

When you are ready – register your business with Tide for £14.99

Registering your business with Tide is incredibly fast, easy and only £14.99. You not only get to officially start your company, but you get a free business bank account at the same time, which is the best way to ensure you’re keeping your finances in order from day one. Be your own boss and register your company with Tide!

4. Find the right pricing strategy

Now that you know your costs, you can think about your pricing strategy.

As mentioned, markup pricing is a simple way of pricing your items. Two other common options are:

- Dynamic pricing

- Market-based pricing

Dynamic pricing

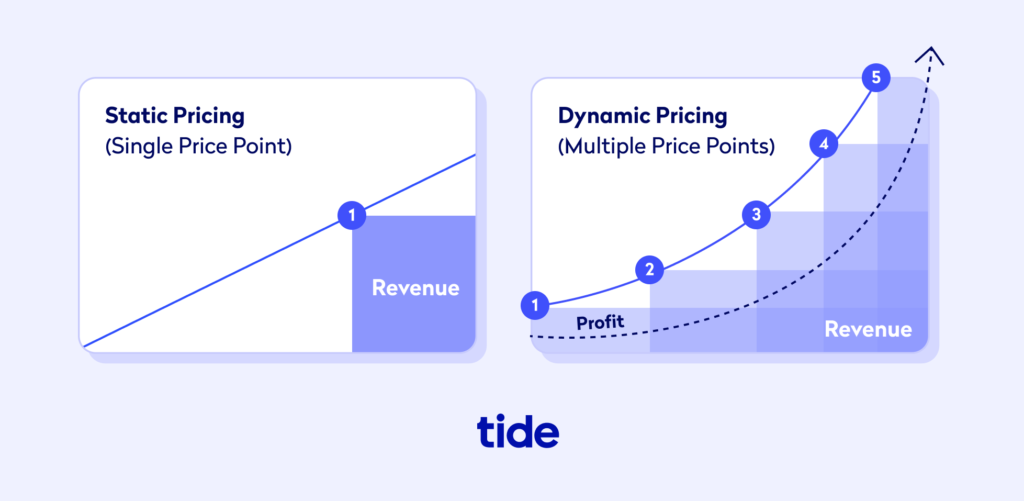

Dynamic pricing is a pricing strategy in which prices constantly change based on market demand. If demand is high, prices can be raised and if demand is low, prices can drop.

It’s a popular strategy in e-commerce, where data can be used to change prices daily, or even hourly (doing this physically in a store would be almost impossible), to match consumer habits.

The below image shows how dynamic pricing can benefit an e-commerce business when compared to static pricing:

With a single, static price point, you may miss out on customers on either side of the axis. With dynamic pricing, you have multiple price points to consistently stay competitive.

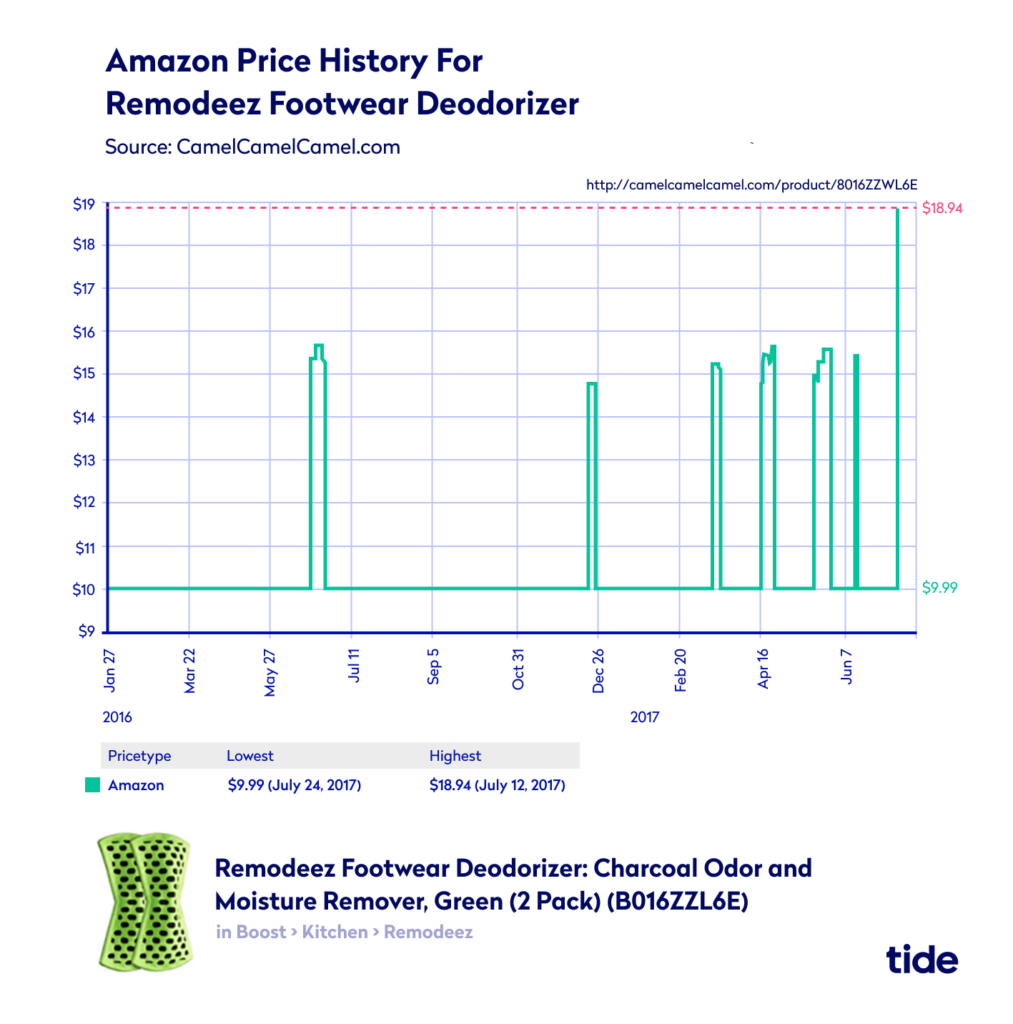

The best example of a business successfully using dynamic pricing is Amazon. The below image, used in a report by CBS News, shows how the price of Remodeez Footwear Deodorizer fluctuated over a few months.

With as many as 96% of shoppers saying that they plan on comparing prices before making purchase decisions, dynamic pricing can be a good way to keep sales steady.

Given how much data is involved in areas such as time, competition, supply and demand and customer behaviour, it’s not something you could implement manually. Luckily, you don’t have to as there are dozens of programs out there to help you automate the process.

According to software comparison site Capterra, the best dynamic pricing tools on the market are:

- Competera

- Quicklizard

- Dynamic Pricing by Omnia

- PriceGain

- PriceLab

These platforms can help you stay competitive and save you valuable time and money.

Market-based pricing

Market-based pricing involves setting your prices to reflect current market prices for the same or similar products.

It’s a strategy used often in everyday life, from the cost of meals in restaurants like McDonald’s and Burger King to the price of iPads and Samsung Galaxy Tabs to the monthly subscription prices set by Netflix, Disney+ and NOWTV.

You can calculate your market-based price as follows:

Cost of product + market factor price (competitor prices) + premium (the added value of your product) = market-based price

When you know the industry average price for similar products, you have three options for your own pricing:

- Price higher

- Price lower

- Price the same

Choosing the right option correlates directly to your business goals, specifically how you want your brand and product to be perceived.

1. Pricing your products higher than the market

If you decide to price your products higher than the competition, you’ll be able to position yourself as having a higher-quality product.

This is where the ‘premium’ aspect of the above equation comes into play: what added value can you offer to lure consumers?

If your product has no obvious premium, think about how you can stand out in other ways to boost your perceived value.

For example, if you’re selling a mug that’s the same size and has a similar design to one offered by a competitor, you might justify your higher price tag by including tea and biscuits in your package.

While it doesn’t cost you much to include these additional items, the extra effort sets you apart from the competition. Your customers will most likely enjoy the unique offering and thus accept the higher price point.

2. Pricing your products lower than the market

A lower price will make it easier to attract customers, but you’ll need to do more work to convince them that your product isn’t inferior. This can be done through strategic marketing initiatives that focus on both your product and your brand positioning.

For example, you can create a unique experience that deters customers from caring about whether a lower price equates to lower quality.

IKEA does this brilliantly. They’ve created a completely unique in-store experience, complete with a restaurant (with signature dishes like Swedish Meatballs), a kids play area and an interactive browsing adventure.

When you go to IKEA, you have a good time and therefore don’t mind that the quality is potentially subpar in relation to competitors. They’ve positioned their brand as a family-friendly place where you can come to spend an entire day shopping.

In fact, their store is so big and set up in a maze-like fashion, that you end up buying things you didn’t even plan to because you are forced to walk by every single product. And to free up your hands, they’ve got free lockers that you can use for your personal belongings.

The lower prices and quality doesn’t matter because the experience itself creates added value.

3. Pricing products the same as the market

Opting to sell products at the same price as competitors help you stay competitive and keep your profit margins steady.

But it can also mean acquiring the same customers as your competition rather than building your own base, thus making customer loyalty more difficult to maintain. And loyalty is important. According to Hubspot, a 5% increase in customer retention can increase company revenue by 25-95%.

To price your products at the same price point as your competition and also build a loyal customer base, you need to position your products and brand as the superior choice. Then, you need to work to keep customers happy with good communication, excellent customer service and rewards.

75% of customers in a study by PEGA said they will leave a brand because of poor customer service, but 75% in another study by Virtual Incentives say they favour companies that offer rewards.

If you can outperform the competition with outstanding customer service and a captivating rewards program, you’ll keep customers on your side.

Top Tip: To learn more about how to market your products and organically drive customers to your value proposition, check out our small business guide to marketing on a budget ✨

5. Consider other product pricing factors

Before you settle on an initial price for your product, there are other factors to take into account that may influence revenue and profit margins.

Here are four things to consider:

1. Value Added Tax (VAT)

If your annual taxable sales are over the limit set by HMRC (currently £85,000), you’ll need to register for VAT and add the VAT rate of 20% to all products sold (unless you sell VAT exempt items). This will mean a t-shirt that costs £20.00 will cost £24.00 and you may need to cut costs elsewhere to keep prices competitive.

Top Tip: To learn more about VAT and understand exactly how to calculate the correct amount that applies to your business, read our guide to everything you need to know about VAT 🔍

2. Selling in different territories

If you plan on selling products internationally, you may need to set different prices to suit the particular market.

For example, selling a t-shirt for £24 might be fine for the UK market where the average salary is around £30,420/year. But in India where the average salary is £1,669, £24 might be too expensive.

To find the average salary in every country around the world, visit the WorldData site. And to find the median household income by country, visit the World Population Review site.

You’ll still want to make a profit on your products, so think carefully about which markets you want to target.

3. Ecommerce and/or in-store?

Running an online store means you don’t need to pay for rent, business rates, utility bills and display unit costs.

If you’re selling online, these cost savings can be passed on to customers by pricing your products lower. If you’re selling in-store as well as online, you’ll need to decide whether to have different prices for each channel or the same across the board.

4. Selling on credit

If you’re selling high ticket items such as furniture or computer systems, for example, offering credit can make it easier for customers to afford your products. It can be profitable too – over 80% of customers say that finance heavily influenced their decision to buy, with 48% spending more as a result.

However, you’ll need to factor the cost of a finance company into your prices. Also, having every customer on credit can affect cash flow, so you’ll still want to attract upfront buyers. To do this you might set upfront prices lower than the credit option.

Considering these other factors and how they impact your costs and customers will help you prevent pricing mistakes.

6. Monitor your prices

Whether you opt for markup pricing, dynamic pricing or a market-based strategy, you must consistently monitor your prices to ensure each product you sell is making you money.

But don’t rely solely on what the competition is doing to adjust prices. Keep in close contact with your customers to gauge their expectations and adjust accordingly.

In the same way that you sought customer insights to help price your product initially, regularly ask them what they think about your pricing and use their feedback to keep your prices relevant.

You should also consider price elasticity and how the ability to experiment with pricing can depend on both product type and customer demand.

Price elasticity

Price elasticity measures the responsiveness of demand to a change in price.

Products can either be inelastic where a change in price causes a smaller percentage in demand, or elastic where a change in price causes a bigger percentage in demand.

You may be able to raise your prices more readily if you’re selling something that is inelastic, with no real competition or alternative.

For example, if Apple decides to put the price of its latest iPad up by £100, people will still buy it because the Apple brand is strong. If, however, Acer decided to put the price of its laptops up by £100, demand is likely to be more elastic because the brand isn’t as strong and there are dozens of other comparable laptop brands available.

But it’s more than the product you sell or the strength of your brand and marketing. Elasticity factors in customer income and the health of the economy, as well as what your competition is doing.

So it’s important to regularly monitor prices to see how each price change affects the demand and profitability of your product.

With this information, you can experiment with prices and make changes to suit your market.

To help you get to grips with price elasticity, a couple of good resources to check out are Economics Help’s jargon-free guide and Amy Gallo’s Refresher on Elasticity post for Harvard Business Review.

Wrapping up

Pricing is different for everybody and what works for a competitor won’t necessarily work for you. Therefore, it’s key that deeply you understand your customers as well as the market you exist in and choose a strategy that best suits your product and brand positioning.

The key things to remember are that your prices must always cover your costs and pricing should always be dictated by the market. Your prices can be higher or lower than rival products, but they should always stay competitive.

Photo by Andrea Piacquadio, published on Pexels